Invest from £50 in five steps through HSBC UK mobile app

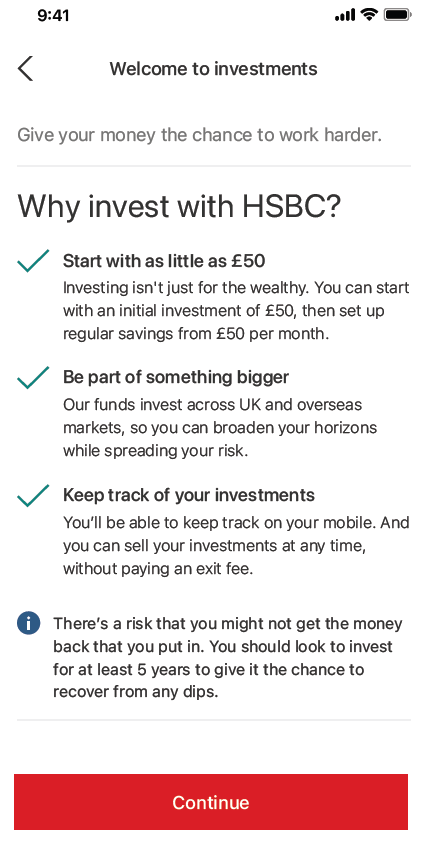

As part of its commitment to making investing more accessible, HSBC UK has announced customers will be able to invest from £50 in just five easy steps via its mobile banking app.

The move comes as research commissioned by the bank reveals one in four adults aged 18-34 have never considered investing. Two thirds of this age group (64%) say investing is difficult to navigate, whilst six in ten (62%) think they don’t have enough money to invest1.

To help break down these barriers to investing, HSBC UK has now added an investment feature to its mobile banking app. Users can open a Global Investment Centre account and choose from a selection of ten ready made HSBC global strategy portfolios with different risk ratings.

This includes five HSBC sustainable fund portfolios which aim to invest more in companies with a higher ESG score average and a lower carbon footprint than the market.

James Hewitson, Head of Wealth Management at HSBC UK, said: “Around 389,000 of our customers aged under 35 have sufficient assets to invest2 but are currently not doing so. If you have an emergency fund of 3-6 months of living costs and can afford to put away at least £50 a month, then investing can really help you grow your money.

“On top of that, 64% of HSBC customers are digitally active. Our online advice service, HSBC My Investment, already provides an accessible and low cost route to investing for novices. With the addition of mobile, we’re offering more opportunities for savers to try out investing and make their money work harder.”

HSBC UK customers can start investing from £50 a month or a lump sum of £1,000 either through HSBC’s online investment advice platform, My Investment or the Global Investment Centre (GIC). Currently 62% of My Investment users are first time investors. Help and support on investing is available seven days a week from our UK based team via Live Chat.

The investments feature on mobile is part of a range of updates made to the HSBC app in the last few months. Customers can now change their address, manage subscriptions and raise disputes through the app for the first time.

Customers will be need to download a new version of the HSBC mobile banking app in order to access the Investments feature. The new update will be available from the App Store for iOS and Google Play Store for Android over the coming weeks.

Media enquiries to:

Hannah Langston, HSBC UK Press Office: 07384 792 248 | hannah.langston@hsbc.com

For the latest news and updates, visit the HSBC UK newsroom:

https://www.about.hsbc.co.uk/news-and-media

Notes to Editors

1Survey commissioned by OnePoll. Sample size was 2,000 UK adults ranging from 18-55+. Fieldwork was undertaken between 11-14 June 2021. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

2Sufficient assets = 3 months emergency fund and £1,000 to invest.

The value of investments, and any income from them, could go down as well as up, and you may not get back what you invest. This may also happen as a result of exchange rate fluctuations, as some investments have exposure to overseas markets. Investing should be seen as a medium to long-term proposition, for example, at least five years.

HSBC UK

HSBC UK serves around 15 million customers across the UK, supported by 25,500 colleagues. HSBC UK offers a complete range of retail banking and wealth management to personal and private banking customers, as well as commercial banking for small to medium businesses and large corporates.

HSBC Holdings plc HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 64 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of US$2,976bn at 30 June 2021, HSBC is one of the world’s largest banking and financial services organisations.