HSBC UK to open new branch in Loughborough

The plans for the new branch, which will be located a few doors down at 31 Cattlemarket, will require planning permission through Charnwood Borough Council and will bring the bank’s latest technology and design, including significantly improved accessibility for wheelchair users, mobility impaired, partially sighted or neuro-diverse customers.

The branch will also have a Safe Space for anyone in immediate need of discrete space to reach out to friends and family, contact specialist support services or to phone a helpline.

The fire, which Fire Service investigations showed to be caused by an electrical fault between the second and third floor, led to significant fire and water damage across the whole building, compromising the structure of the listed building. Extensive work is being carried out to make the building safe, repaired and restored in accordance with listed building and planning requirements, working closely with Charnwood Borough Council. It is expected the required work will be completed by April 2025.

Oli O’Donoghue, Managing Director for HSBC UK’s Branch Network, said: “Branches continue to play an important role for us and our customers and we are committed to having a strong presence on the high street. We are investing tens of millions of pounds in updating and improving our branch network and in addition to opening two new branches in 2023, we refurbished or updated almost 70 others, with a schedule to continue this into 2024. We are proud to be cementing our relationship with our customers in Loughborough, continuing our links to a rich 200 years of banking history in the town.”

Gursh Bassi, HSBC UK’s Local Director, said: “I am proud of the hard work my team in the Loughborough branch has put in to provide a continuous service for our customers in difficult circumstances in addition to thanking our customers for their patience and understanding during these difficult months. I would also like to say thank you to Charnwood Borough Council for allowing us to have our pop-up branch in their Town hall while alternative arrangements are being put in place.

“I am pleased to say that there is light at the end of the tunnel, planning permission allowing, and I hope to be able to bring the latest technology and design to our customers in Loughborough as early in 2024 as we possibly can.

“While we will be working as quickly as we can to open the new branch, we will continue to provide our pop-up branch in the Town Hall. In addition to our Leicester Clock Tower branch, customers can use the new Banking Hub in Syston or any Post Office for day to day transactions like depositing or withdrawing cash, plus mobile and online banking is available 24/7. There is additional support available by calling our contact centre. Customers can find the best number on the back of their debit or credit card.

“We are very excited about this new era for HSBC UK in Loughborough and look forward to welcoming our customers into our new home very soon.”

Making banking history in Loughborough

(Source: Bulletin of the Loughborough Archaeological Society, written by Edwin Green, Midland Bank Group Archivist)

In the late 18th and early 19th centuries, local banking services in England and Wales were provided by many hundreds of small private firms, accepting deposits, settled payments on behalf of traders and customers, with some issuing their own bank notes.

1790 – Middleton & Co, also known as ‘The Loughborough Bank’, was founded by William Middleton, offering banking services to Loughborough’s population of 4,000.

1843 – William Middleton died and was succeeded as senior partner by his son Edward Chatterton Middleton. Despite competition from competitors who arrived in the town, Middleton & Co remained the pre-eminant bank.

1878 – Edward Chatterton Middleton dies. Described as ‘almost a necessary institution in the town’, his passing led to a ‘short but dramatic crisis’ in Leicestershire Banking. The Leicestershire Banking Company opened a branch in Loughborough and subsequently agreed to acquire the buildings and business of Middleton & Co.

The Leicestershire Banking Company was founded in Leicester in 1829 and by 1900 was the largest bank in Leicestershire, with no less than 28 branches.

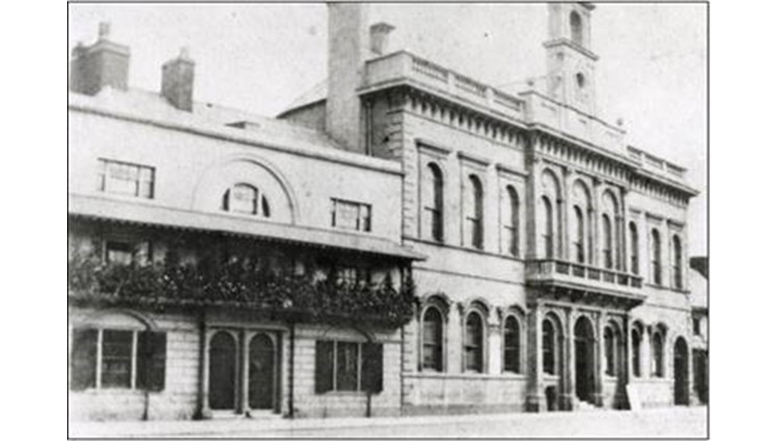

1890 – Architects Goddard & Paget reported the building (image 1 below) to be ‘in a very dilapidated state, with a very ‘low and inconvenient’ banking room.

1892 – Goddard & Paget were commissioned to design an entirely new building, which was completed in 1894 at a cost of £6,200. The builders were local firm W Moss & Son.

1900 – Leicestershire Bank is acquired by Midland Bank.

1930 – Due to the growth of the Loughborough branch, the number of branch staff doubled from 7 in 1900 to 15 in 1930.

1962 – A ‘sub branch’ is established at the then Loughborough College of Technology.

1974 – A studentship scheme in banking and finance for Midland entrants was developed by the University and the Bank.

1985 – Loughborough University’s Banking Centre is opened with Midland Bank Support.

1992 – Midland Bank is acquired by HSBC.

2018 – Government ring-fencing rules introduced, leading to the incorporation of HSBC UK with Loughborough branch re-branded.

2023 – HSBC UK’s Loughborough branch is devastated by fire.

Media enquiries:

Email: UKPressOffice@hsbc.co.uk

Notes to editors:

HSBC UK

HSBC UK serves over 14.75 million customers across the UK, supported by 24,000 colleagues. HSBC UK offers a complete range of retail banking and wealth management to personal and private banking customers, as well as commercial banking for small to medium businesses and large corporates. HSBC UK is a ring fenced bank and wholly owned subsidiary of HSBC Holdings plc.

HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 62 countries and territories. With assets of $3,021bn at 30 September 2023, HSBC is one of the world’s largest banking and financial services organisations.